Our History

Four generations of leadership

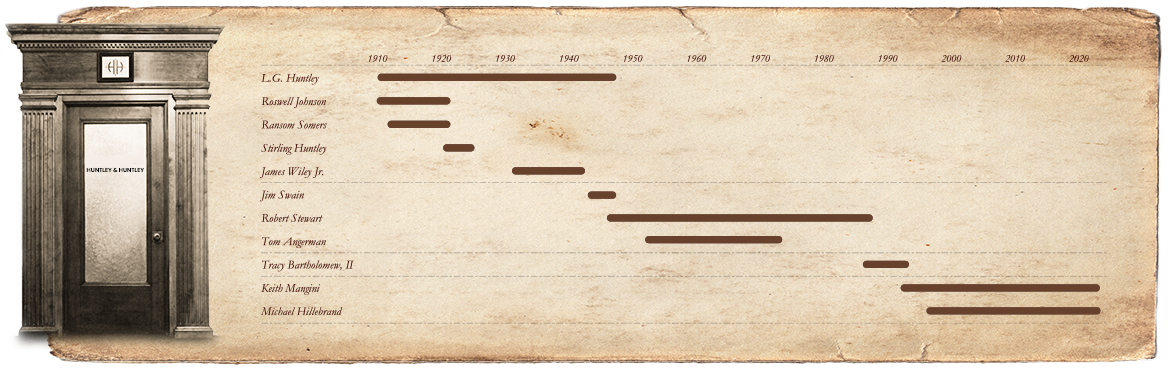

As we look back on our history, we prefer to see it through the eyes of those who wrote the Huntley story. We believe that their personal accounts of the events that took place over the years are more meaningful than a dry list of occurrences. We divide our history into four generations, each of which made a unique contribution to shaping the company's path.

This doorway was a gift to Huntley from the Benedum family.

Generation I

Louis Grow (L.G.) Huntley

B: 1885 - D: 1970

L.G. was born on July 22, 1885, in Greenville, Michigan and at age ten, moved to Millvale, Pennsylvania. He started from humble beginnings, fought for an education, and then climbed, unaided, to the top of his chosen profession. From a young age until the time he graduated from college, L.G. amassed thirty-five work experiences doing mostly steel mill forgery jobs which helped him fund himself through college. He was one of 200 individuals to be within the maiden 1908 graduating class of Carnegie Technical School (current day Carnegie Mellon University), to which he was one of only 40 students to graduate with a B.S. degree in Metallurgical & Mining Science.

Once graduated, L.G. traveled extensively to three continents, primarily exploring and venturing within remote, uncivilized areas of many countries, including Mexico, Ecuador, Columbia, Brazil, and Venezuela. While traveling, he once again picked up any job that advanced his curiosity to see the world. On several occasions during these travels and within different locals, L.G. witnessed natural occurring oil seeps typically used by the locals for medicinal purposes. With the discovery of oil as a lubricant and world changing fuel back in Pennsylvania, L.G.’s career path led him to become an exploration geologist.

L.G. returned to Pittsburgh in 1911. In 1912, L.G. started an engineering and geologic consulting business for oil and gas with Roswell Johnson, which was originally called Johnson & Huntley. While consulting, L.G. continued his education at the University of Pittsburgh focusing on geology. In 1922, L.G. earned his M.S. in Geologic Science.

Among professional confreres, L.G. is credited with the discovery of several of the richest oil fields in the Western Hemisphere. His reputation rests not only on his readiness to go into primitive areas to look for oil, but on his ability to find it through his own interpretation of geologic structure. L.G.’s international fieldwork and geologic and engineering reports were the basis of many of M.L. Benedum’s (The Great Wildcatter) successful oil discoveries throughout the world.

In approximately 1928, L.G. started a mineral and royalty company called Papantla Royalties. With this company, he negotiated several oil concessions from Mexico and additionally purchased over 400,000 acres of lease royalty rights within the Tampico embayment areas. These areas are currently known as the Ebano, Panuco and Tuxpan oil fields. After Papantla purchased these acres, the company subsequently contracted with Standard Oil Company to develop their concessions and leases. In March 1938, as Standard Oil started developing the concessions with major field discoveries, Mexico nationalized its oil and gas ownership and expropriated all foreign ownership. Mobile Oil (current day remnant of Standard Oil) and Papantla Royalties fought the expropriations in court until 1973 when the outcome yielded Papantla no consideration and a complete loss of L.G.’s assets within Papantla. As a result of this experience, L.G. always advised if you are going to invest in a foreign company, you had better own an army. Mexico’s National Oil company, Petróleos Mexicanos (PEMEX), not only developed these three fields but others in the area that have been known worldwide as Mexico’s “Golden Belt” of oil, which has produced over 160 billion barrels of oil.

In 1948, L.G. retired in McAllen, Texas where he lived until his death. At retirement, L.G. sold his interest in the company to Jim Swain and Bob Stewart.

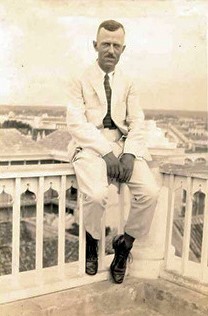

L.G. in Maracaibo, Venezuela

Roswell Hill Johnson

B: 1877 - D: 1967

Roswell was born on October 9, 1877, in Buffalo, New York. Roswell attended Brown University, Harvard, and the University of Chicago to obtain his B.S., M.S., and Doctorate degrees, all of which were within science disciplines. From 1905 – 1908, Roswell worked for the Carnegie Institute of Technology to which his worked exposed him to the oil and gas industry in the western portion of the United States.

In 1908, Roswell entered the oil and gas industry as a geologic consultant in Bartlesville, Oklahoma. It was in Oklahoma that Roswell and L.G.’s paths crossed. In 1912, Roswell moved to Pittsburgh to become a lead professor at the world’s first accredited petroleum engineering curriculum at the University of Pittsburgh, Swanson School of Engineering. With extensive current geologic and scientific understanding of the engineering and geologic principles of the oil and gas industry, Roswell and L.G. combined their consulting work under the name Johnson & Huntley in Pittsburgh.

As consultants, Roswell and L.G. performed some of the earliest scientific research and engineering related to oil exploration and production for the newly formed United States Bureau of Mines. Subsequently, they both were retained to perform like-kind work for the Canadian Bureau of Mines. Roswell and L.G. wrote the first petroleum engineering handbook and were the first to teach classes on petroleum exploration and production engineering at the University of Pittsburgh. In 1916, Roswell and L.G. wrote the first oil and gas engineering textbook called The Principles of Oil and Gas Production. The textbook was the primary curriculum used by other universities to expand into higher education for oil and gas.

In 1922, Roswell’s career focus turned purely academic as he decided to focus his career full-time on higher education, leading the Petroleum Engineering department at the University of Pittsburgh until 1934. Upon Roswell’s departure, L.G. purchased his interest in the company and then changed the name to Huntley & Huntley, as L.G.’s younger brother, Stirling, had just started working for him.

Ransom Evarts Somers

B: 1885 - D: 1980

Ransom Somers was born in Middlesex, Massachusetts, on July 28, 1885. He graduated from Harvard with B.A. and M.A. degrees in Art of Geological Education and obtained his Doctorate degree from Cornell University in Geologic Science. In 1914, Ransom moved to Pittsburgh to become a professor of Oil and Gas Geology at the University of Pittsburgh within the Department of Oil and Gas Engineering.

Ransom had already been acquainted with Roswell and L.G. as both men had been called upon frequently to guest lecture on the latest foreign oil and gas field discoveries and production responses. In 1915, Ransom was brought in as a partner in the company. Ransom worked on many oil and gas projects and had mostly public, but also several private, oil and gas geologic publications, including early publications within the United States Geological Survey and the United States Bureau of Mines.

In 1922, Ransom, Roswell, and L.G. wrote and published an oil and gas finance and economics book called The Business of Oil Production. During that time, the book was sold to many entering the oil and gas industry throughout the country. During this same year, Ransom left the company to work for Gulf Oil Corporation where he remained through Word War II. Upon his departure, Ransom sold his interest in the company to L.G.

Stirling (Charles) Huntley

B: 1896 - D: 1926

Stirling Huntley 1925

Stirling Huntley was born on November 24, 1896, in Emsworth Borough, Pennsylvania. Stirling was L.G.’s younger brother and he received his geology degree from the University of Michigan. Following in his older brother’s footsteps, Stirling became an oil and gas exploration geologist. In 1920, he started working as Chief Geologist for Island Oil and Transport Corporation in Tampico, Mexico.

With the departure of Roswell and Ransom in 1922, Stirling returned to Pittsburgh to work with L.G. and the name of the business was changed to Huntley & Huntley. Unlike L.G., Stirling was a sharp dresser and preferred to do oil and gas business in the office rather than the field. He spoke three languages and traveled the world bringing the company many consulting projects. He quickly earned his own reputation as a respected geologist who was an extraordinary oil and gas businessman.

In 1926, while overseeing a project for the Rig Lake Oil Company, Stirling was traveling through Zapata County, Texas, near the town of San Ignacia. While traveling, Stirling was flagged down and stopped to help two young men, Hernando Williams and Cruz Martinez. Williams and Martinez had just robbed a bank and had to pull over due to a flat tire. When Stirling pulled over to help them, the two men shot him, robbed him, and then tossed Stirling into a nearby creek. Williams and Martinez then stole Stirling’s car and headed for Mexico. As they attempted to cross the border, agents noticed Williams was wearing a fancy watch – the watch they stole from Stirling. With suspicion, the authorities searched the car and found the money from the bank the two men had just robbed and both men were immediately arrested. Back in Pittsburgh, upon the realization that Stirling had gone missing, oil industry leaders organized a search party with the intent of retracing Stirling’s travel plans. In doing so, the criminal’s car was found with a flat tire along the road near the town of San Ignacia. While searching around the abandoned car, Stirling’s body was found in the nearby creek and his murder was reported to the authorities. With Williams and Martinez already in custody for bank robbery, the car they stole was linked to Stirling’s murder. When questioned, both Williams and Martinez admitted to shooting and robbing Stirling. Both men were tried and immediately hung for their crimes.

Following his tragic death, nearly 100 representative oilmen, including operators, geologists, and scouts met at the office of Sims Oil Co. of Laredo, Texas. While Stirling was a newcomer to Texas, they declared he was as a young man of splendid character and recognized ability, a friend to many, and his death was a great shock to the oil fraternity. In honor of Stirling’s tragic death, the name of the company has never changed from Huntley & Huntley as new partners participate in the business.

James (Ben) Wiley Jr.

B: 1897 - D: 1974

Ben was born in 1897 in Pittsburgh, Pennsylvania and received his B.S. degree in engineering from Dartmouth. In 1927, Ben started working for Huntley & Huntley as an engineer and in 1933, bought into the company as a partner. Ben was well-known and highly regarded as a reserve and operational engineer whose major client was M.L. Benedum.

Ben was the Benedum’s highly respected signatory for the Oil and Gas Reserves Report for M.L.’s company, the Benedum Trees Oil Company. Ben was often called upon to defend and reconcile IRS tax audits of the Benedum’s oil and gas interests. Ben’s engineering skills brought the United States Core of Engineers to Huntley & Huntley as a client. Through Ben, Huntley & Huntley performed early geologic fault and soil studies to early Core flood control and freshwater dam and reservoir projects. Huntley also provided the Core with oil and gas valuations, plug and abandonment procedures, and oversite for condemned oil and gas properties within the area of disturbance involving the dammed waters. The Core used Huntley & Huntley throughout the country where oil and gas properties interfered with project design and execution.

In 1943, during the last years of World War II, oil and gas professionals became less available and Ben left Huntley & Huntley to work for M.L. Benedum as their vice president. Following his departure, L.G. purchased Ben’s interest in Huntley & Huntley. Ben worked for the Benedum’s until he retired.

Generation II

Jim Swain

B: 1903 - D: 1948

Jim was born on August 20, 1903, in Dillonvale, Ohio and moved to Wilkinsburg, Pennsylvania, in 1912. Jim received his geologic engineering degree from the Carnegie Institute of Technology. Following graduation, he served in World War II as a pilot. Immediately after the end of World War II, Jim had little oil and gas engineering experience, but because of his impressive intellect and exceptional communication skills, L.G. brought him into the company directly as one of his partners.

Immediately following Jim joining the company, he successfully gained the Mellon Estate as a client for Huntley & Huntley where he oversaw the Estate’s oil and gas investments and annual valuations, including the Estate’s ownership interest in Gulf Oil. To help camouflage the Mellon’s name from recognition of its oil and gas endeavors, Jim suggested the Mellon’s place their oil and gas estate under the name Nollem (Mellon spelled backwards), which the Estate still carries its interests under today. Jim was also one of the founding fathers of the Pittsburgh Geological Society which was formed in 1945.

On October 4th, 1948, Jim was returning from Virginia on Nollem business in a plane owned by E.P Mellon, II to make it back to Pittsburgh to speak at an evening event for the American Association of Petroleum Geologists (AAPG). The plane stopped in Charleston, West Virginia to refuel, but within ten minutes after takeoff, the right engine caught fire and crashed just north of Charleston. Jim, age 44, and the pilot were both killed in the crash. Bob Stewart, who had just joint purchased L.G.’s business interest with Jim upon L.G.’s retirement, then purchased Jim’s ownership interest from Jim’s estate, leaving Bob Stewart as the only remaining partner in the company.

Robert S. Stewart

B: 1920 - D: 1988

Robert was born on February 17, 1920, in Pittsburgh, Pennsylvania but moved to Florida during his childhood. During high school, Bob came back to Pittsburgh from Miami with his mother as his father had passed away when he was a child. His mother was a strong, independent woman who appreciated social position and she instilled this culture in raising Bob as a single mom. Bob received his B.S. in Geologic Engineering from Princeton and his M.S. in Chemical Engineering from the University of Pittsburgh.

In conjunction with his graduate studies, Bob was hired at the Mellon Institute of Industrial Research where he spent several months on special assignment for the U.S. Army in Indio, California. There he worked on a U.S. Government Top Secret project for the U.S. Desert Warfare Board. Following his work for the U.S. Army, the U.S. Government recruited him to work for the United States Naval Reserve and sent him to MIT and Harvard for electronic engineering and radiation laboratory studies. As a result of his advanced studies, Bob became a specialist in advanced radar technology for the U.S. Government, specifically the Navy. Immediately prior to World War II’s Normandy Invasion, Bob was deployed to England as a Division Radar Officer to oversee the Navy’s radar service while at war through D-Day. Following Normandy, he served as the Radar Officer for both the Escort Division Six Atlantic Fleet and the Escort Division Sixty-One Pacific Fleet. In 1946, after finishing his Navy service after the end of World War II as the commanding officer of the USS Lough, Bob was honorably discharged from the Navy. While his service to our country was short, Bob was awarded four battle stars, earned European, Asiatic, and American Theater of Operations Ribbons, was granted the Philippine Liberation Medal, and lastly, the Victory Medal.

In 1946, Bob returned to Pittsburgh where his mother’s circle of social influence had her well acquainted with a legendary oil and gas gentleman named Sam Brendel, whose oil and gas resume included the discovery of the massive McKeesport, Pennsylvania, natural gas field. Sam used Bob’s intelligence as a consultant on many oil and gas projects and within no time, Bob amassed an incredible understanding of oil and gas engineering and geologic principles as well as oil and gas well construction techniques. Upon Sam’s death, Bob brought Huntley & Huntley the Brendel oil and gas estate for valuation. At the time, Jim Swain was L.G.’s only remaining partner.

In January 1948, with Bob’s family connections to Pittsburgh’s social elite, his esteemed Navy service, his impressive understanding of the fundamentals of the oil and gas business, and his link to the Brendel oil and gas estate, L.G. hired Bob as a senior engineer. Within five months, Bob became a partner and vice president of Huntley & Huntley when he and Jim Swain split purchased L.G.’s ownership interest upon L.G.’s retirement. Within three months of partnering with Jim to carry Huntley & Huntley forward, Jim Swain died an untimely death in a plane crash. Bob purchased Jim’s interest from the family estate, yielding Bob 100% ownership until Tom Angerman joined the company in 1974.

Bob was a quiet force within our industry who never had the risk aptitude to invest in oil and gas opportunities himself or as a company. Almost everyone referred to Bob as Mr. Stewart. During his tenure, a vast number of oil and gas investment projects only advanced once approved by Mr. Stewart’s final analysis. A typical seal of approval was most often returned to the client with a stain from a coffee spill or a cigarette burn tattooed within the documentation because of Bob’s thorough review of each project seeking his company’s approval. In 1950, Bob purchased Royalty Oil Company, which was founded in 1902, and owned over 50,000 net mineral acres in West Virginia. While much of the acreage position is outside of the current day Marcellus and Utica unconventional Utica Shale development, the investment has returned many multiples of annual cash to its purchase price.

Tom Angerman

B: 1931 - D: 2013

Tom was born on January 19, 1931, in Monongahela, Pennsylvania and received his B.S and M.S degrees from the College of Wooster in Geology. Tom was Bob Stewart’s partner and served as President of Huntley & Huntley from 1954 – 1974. Tom was proficient in understanding the geologic and economic oil and gas principles involving multiple oil and gas basins, especially the Appalachian Basin. His recall of material evolutionary changes within the oil and gas industry always yielded fascinating stories of incredible oil and gas history which many times included some degree of his personal involvement.

Tom always desired to participate within the exploratory, development, production, valuation, and/or management of the very projects Huntley & Huntley was hired to provide professional oil and gas consulting. In 1974, after 20 years of leading Huntley & Huntley’s consulting services, Tom satisfied that calling by starting his own oil and gas drilling and production company called Angerman Associates, Inc. Tom started drilling Appalachian Basin gas wells in 1975 and by 1997, had built one of the leading independent oil and gas companies in the Northeastern United States.

In 1998, Tom sold the assets of Angerman Associates, Inc., which included over 700 wells, 250 miles of pipeline, and greater than 100,000 acres to Somerset Oil and Gas. Tom’s grass roots asset is now the core Appalachian Basin operating arena for EXCO. After the sale of his company, Tom continued to participate with others and drilled even more wells led by his two sons, Tim and Michael. Tom was extremely respected and well-liked by everyone who knew him. Upon his passing on March 22, 2013, his funeral brought a crowd of well-established oil and gas men from around the country that overflowed the capacity of the church.

Generation III

Tracy Bartholomew, II

B: 1952 - D: 1994

Generation IV

Keith Mangini

B: 1955

Keith was born on November 18, 1955, in Brownsville, Pennsylvania and graduated from West Virginia University in 1978 with a B.S. degree in Geology. Directly out of college, Keith’s first professional employment started with Huntley & Huntley. Hired by Bob Stewart as a geologist, Keith was quickly exposed to a diverse and responsible role of supporting Huntley’s clients. He very quickly became proficient in prospect evaluation, drill and completion design, engineering and reserve valuations, oil and gas project management, and financial engineering.

Through the years, Keith rose to the ranks of Bob Stewart’s technical lean and became Vice President at Huntley & Huntley. After the passing of Tracy Bartholomew in 1994, Keith had the opportunity to buy Huntley & Huntley. Like Tom Angerman, Keith was very proficient in multi-basin hydrocarbon development and financial disciplines and always desired to drill wells using his expertise rather than performing only consulting for others.

From 1995 through 2009, as the fourth generation of ownership leader, Keith lead the financing, prospecting, and development of over 800 well interests to which over 480 wells were Huntley & Huntley operated. The success of drilling and production operations covered three basins of exposure: the Appalachian, Permian, and Midcon basins. When horizontal drilling technology displaced vertical well technology, Keith lead Huntley & Huntley into Woodford and Marcellus Shale development and mineral and royalty business development.

Huntley & Huntley is currently in partnership with one of the world’s largest private equity sponsors, Blackstone, in the creation of Olympus Energy, formerly known as Huntley & Huntley Energy Exploration. Olympus Energy was built from acres originally leased and owned by Huntley & Huntley in a tier 1, Marcellus and deep Utica acquired acreage position, and is currently under active development. Although Keith recently retired in 2022, he is still highly active on many oil and gas company board of directors, including Huntley & Huntley, LLC, and will continue to be active within the industry.

Keith Mangini in the Founders Hall of the Duquesne Club

Michael A. Hillebrand

B: 1964

Mike Hillebrand in the Huntley Library

Mike was born on March 3, 1964, in St. Mary’s, Pennsylvania and graduated from Penn State University in 1986 with a B.S. degree in petroleum and natural gas engineering. Following his graduation, Mike started his petroleum engineering career as a completions engineer for an international well servicing company out of Alberta, Canada, whose territory became the Appalachian Basin.

Keith and Mike found success working on many projects together prior to Keith’s purchase of Huntley & Huntley. When working together, Keith and Mike found they had a synergistic and successful outcome on client’s oil and gas projects. In 1998, when the opportunity presented itself, Mike joined Keith as a material equity partner and Vice President at Huntley & Huntley. Together, Keith and Mike raised over $150 million via 26 limited partnership businesses. Mike oversaw the drilling, stimulation, production, and gas marketing related to the build-up of 480 operated gas wells in the Appalachian Basin. When drilling and completion technology advanced from vertical well completions to horizontal, Huntley & Huntley once again took advantage of the new business paradigm.

In 2012, Mike lead a contrarian vision to many others advancing the horizontal drill and completion technology to unconventional shale reservoirs. The vision was to follow a wave behind the boon cycles that big capital investor excitement and newly learned oil and gas development advances were evolving. The pitch was not well received within many potential partnering discussions until a discussion with Blackstone.

With the help of this vision, Huntley & Huntley and Blackstone joined together in 2012 to create a Marcellus and deep Utica shale development and production company within southwestern Pennsylvania, a tier one “sweet spot,” using the acreage position Huntley & Huntley had been building for many years. As Olympus continues to grow, and following Keith’s retirement, Mike is now leading the company’s growth as President and Chief Executive Officer and continuing in the path of those that came before him to make Huntley & Huntley successful in any direction it chooses.